sales tax calculator austin texas

You will have to add the surtax amount to the basic sales tax rate to find the final sales tax rate. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Why Does Walmart Com Charge 10 Sales Tax In Texas When It Should Be 8 25 Quora

The states top rate still ranks as one of the highest in the US.

. Your household income location filing status and number of personal exemptions. This rate includes any state county city and local sales taxes. There are no income taxes in Texas.

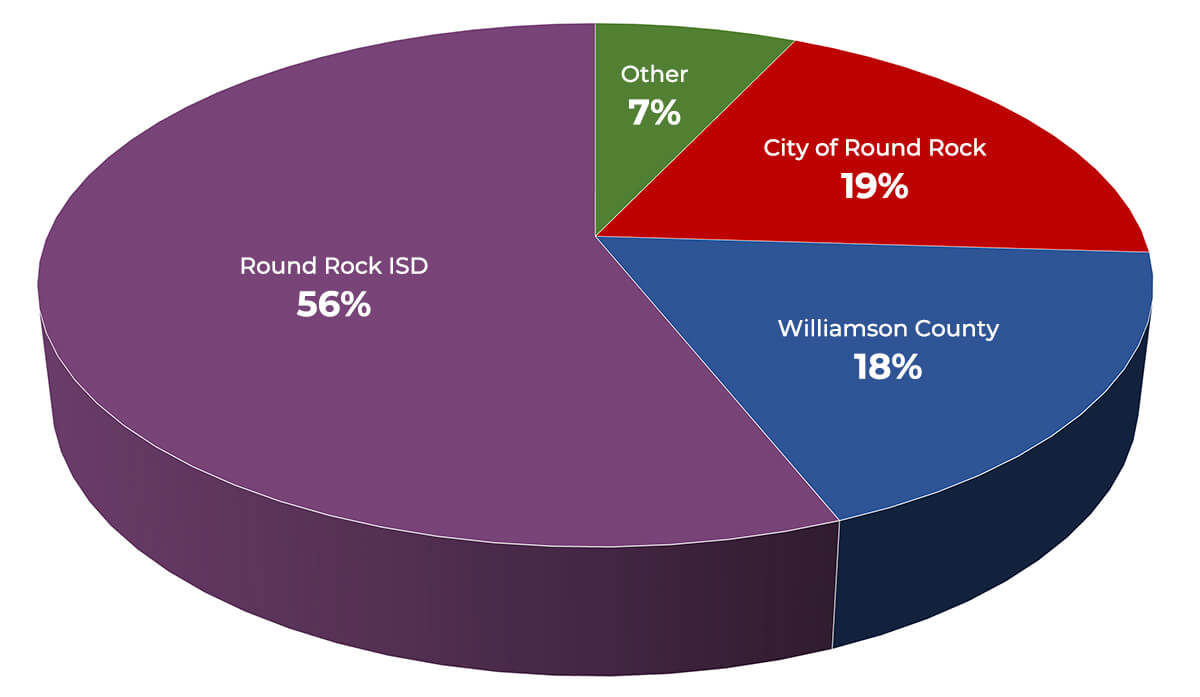

Austin County collects on average 13 of a propertys assessed fair market value as property tax. Click here for a larger sales tax map or here for a sales tax table. Schools are largely funded through property taxes which rise along with home prices.

Combined with the state sales tax the highest sales tax rate in Minnesota is 8875 in the. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year. Minnesota has state sales tax of 6875 and allows local governments to collect a local option sales tax of up to 15There are a total of 277 local tax jurisdictions across the state collecting an average local tax of 0516.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Austin Details Austin TX is in Travis County. 2020 rates included for use while preparing your income tax deduction.

Combined with the state sales tax the highest sales tax rate in Arkansas is 12625 in the city. The median property tax in Austin County Texas is 1903 per year for a home worth the median value of 146500. Up to date 2022 Texas sales tax rates.

The latest sales tax rate for Austin TX. Austin County has one of the highest median property taxes in the United States and is ranked 504th of the 3143 counties in order of median property taxes. Maines statewide sales tax of 550 also ranks among the lowest in the country especially because there are no county or city sales taxes.

Click here for a larger sales tax map or here for a sales tax table. Arkansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 55There are a total of 397 local tax jurisdictions across the state collecting an average local tax of 2636. The sales tax rate in Austin is 825 percent.

Sales Tax Calculator Sales Tax. Use our sales tax calculator or download a free Texas sales tax rate table by zip code. For example in one of the eight counties with a 15 percent surtax there would be a total of 75 percent sales tax charged 6 percent plus 15 percent.

Blog How We Pay For Basic City Services May Surprise You City Of Round Rock

Texas Income Tax Calculator Smartasset

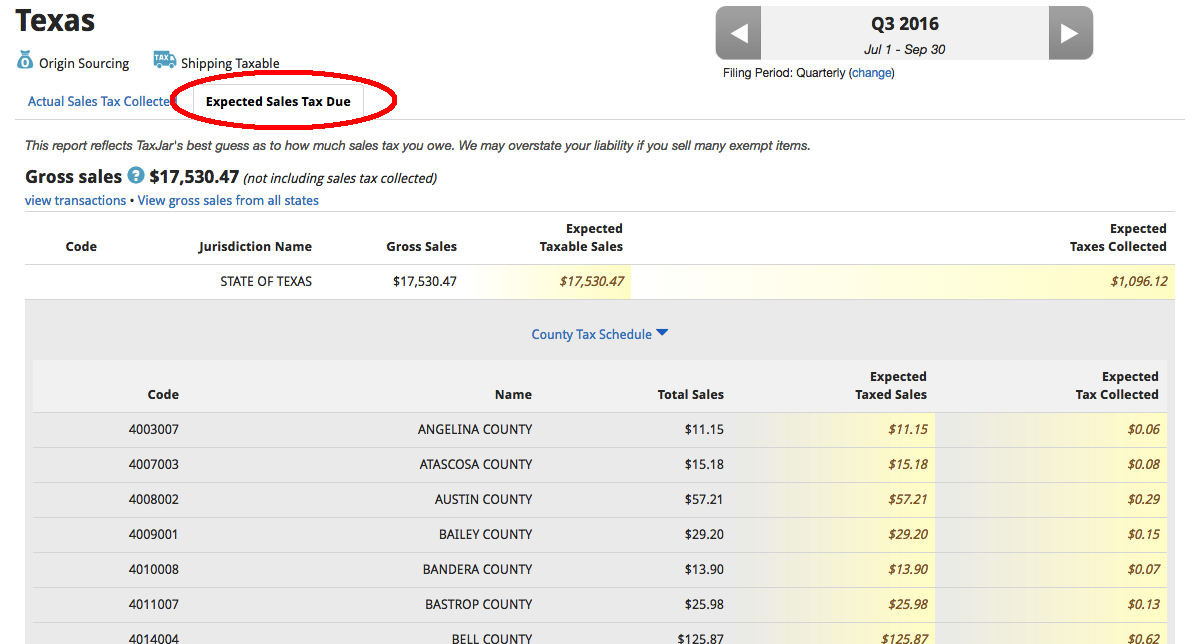

Texas Sales Tax Guide And Calculator 2022 Taxjar

Sales Taxes In The United States Wikiwand

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To Calculate Texas Sales Tax

Texas Income Tax Calculator Smartasset

2022 Cost Of Living In Austin Texas Bankrate

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Why Are Texas Property Taxes So High Home Tax Solutions

Texas Income Tax Calculator Smartasset

Some Texas Online Sellers Receive Alarming Sales Tax Penalty Notification Taxjar

How To Calculate Florida Sales Tax 12 Steps With Pictures

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Texas Sales Tax In 2017 What You Need To Know The Motley Fool

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Rates By City County 2022

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price