refund for unemployment taxes 2020

If you received unemployment benefits in the 2020 tax year due to job loss from the pandemic you could be eligible for a tax refund of up to 10200. Among those tax returns are people who paid taxes on unemployment compensation when they were out of work.

1099 G Unemployment Compensation 1099g

Tax refund for unemployment pay paid in 2020.

. Recipients of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund Federal legislation enacted on March 11 2021 included a provision to exclude up. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. 22 2022 Published 742 am.

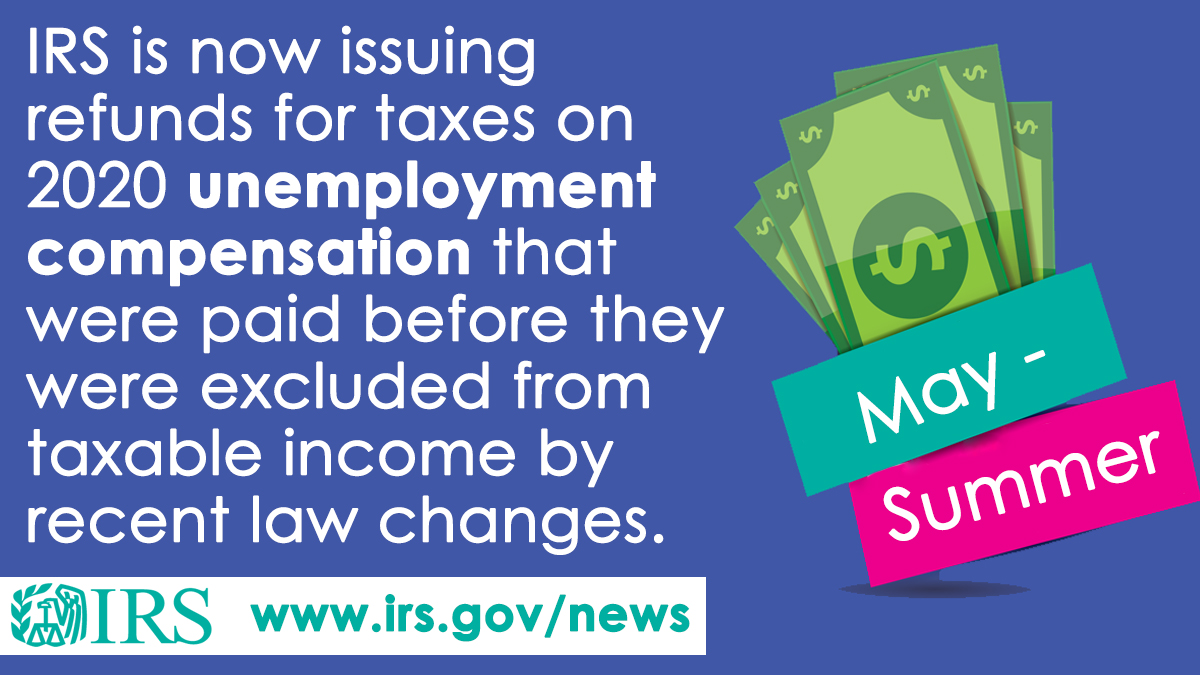

On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the. Why is the IRS issuing these special refunds.

WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on. If you filed your taxes after the ARPA. The most recent batch of unemployment refunds went out in late July 2021.

The only way to see if the IRS processed your refund online is by viewing your tax transcript. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. The IRS has not announced when the next.

Thats because the relief bill allowed 10200 of unemployment income to be collected. Special rule for unemployment compensation received in tax year 2020 only The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. You reported unemployment benefits as income on.

Because we made changes to your 2020 tax account to exclude up to 10200 of unemployment compensation you may be eligible for the Earned Income Credit. What are the unemployment tax refunds. Visit IRSgov and log in to your account.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. COVID Tax Tip 2021-46 April 8 2021. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

In the March 11th Covid-relief American Rescue Plan Congress made up to 10200 of 2020 unemployment benefits. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. The first reflects how they filed and the second refund will reflect any tax break they get on their unemployment.

What is status of my 2020 taxes refund for unemployment I was on unemployment in 2020 the IRS was supposed to I was on unemployment in 2020 the IRS was. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a. President Joe Biden signed the pandemic relief law in.

However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Eligible filers whose tax returns have been processed will receive two refunds. Heres how to check online.

1 The IRS says 62million tax returns from 2020. People might get a refund if they filed their returns. But thanks to the American Rescue Plan many of those people are now due a refund.

You do not need to. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. Normally any unemployment compensation someone receives is taxable.

For example if you were ineligible for the Earned Income Tax Credit but became eligible as a result of the 10200 unemployment subtraction you would have to file an. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax.

Irs Unemployment Refunds What You Need To Know

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Confused About Unemployment Tax Refund Question In Comments R Irs

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

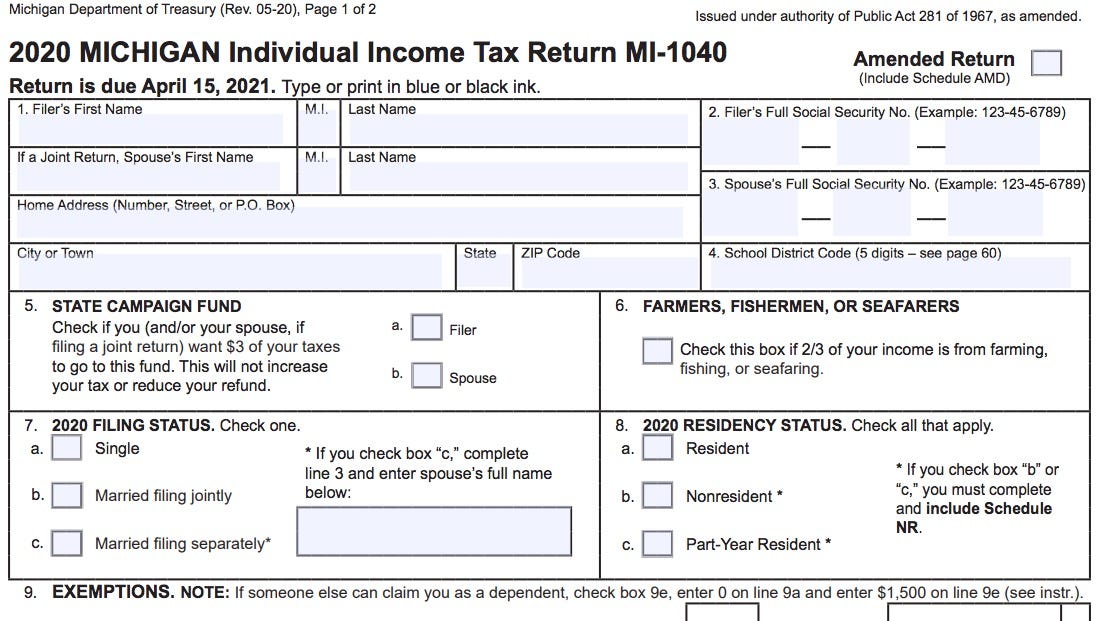

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time